According to eMarketer’s latest US mobile payment forecast, Zelle will be surpassing Venmo as the most popular peer-to-peer (P2P) mobile payment app in 2018. But will the new app be useful to your small business? As one of the newest P2P mobile payment platforms, Zelle has made some impressive gains in a short time.

This is primarily due to the owners of Zelle, some of the leading financial institutions in the world. They include Bank of America, BB&T, Capital One, JPMorgan Chase, PNC Bank, US Bank, SunTrust and Wells Fargo. Meanwhile Venmo is owned by PayPal alone.

The forecast from eMarketer has Zelle growing more than 73% this year reaching a user base of 27.4 million people in the US. This is ahead of Venmo’s 22.9 million and Square Cash’s 9.5 million.

According to eMarketer forecasting analyst Cindy Liu, the growth of Zelle can be explained by the trust it has gained from its users. In a press release, Liu says, “One of the main hurdles new apps face is building trust and a sizable audience. But Zelle has leapfrogged the early stages of adoption by having the benefit of being embedded into the already existing apps of participating banks.”

This is driving the total number of P2P mobile payment users in the US to grow around 30% to reach 82.5 million people, which is 40.5% of US smartphone users.

When it comes to the transaction value of this segment, it is going to grow at an impressive 37% this year to $167.08 billion. And eMarketer is predicting it will go beyond $300 billion by 2021.

The Lack of a P2P Type of Mobile Payment for Business

Although P2P mobile payment systems are used by freelancers and workers in the gig economy, there is not a solution in place for businesses. As René Lacerte reported on Forbes, there is not a Venmo or Zelle for business because the rules which apply for business payments are much more complicated.

Lacerte explains, “The whole process of initiating and making payments is extremely high-touch, with many moving parts, from sending the invoice, honoring your payment terms (hello, Net 30, Net 60 and Net 120), gathering necessary approvals and requiring multiple systems, such as your accounting software and your bank, to talk to each other.”

The Growth of Zelle

While Venmo handled $12 billion in transactions in the first quarter of 2018, Zelle announced it did $25 billion in the same quarter. This was a 15% quarter-over-quarter increase on 85 million transactions.

The company was able to grow so quickly because of the number of banks involved. Currently, more than 100 financial institutions have signed up to participated in the Zelle Network. Users from these institutions can make payments within minutes after they enroll in Zelle. And all it takes, in addition to the bank account, is an email address or a US mobile phone number.

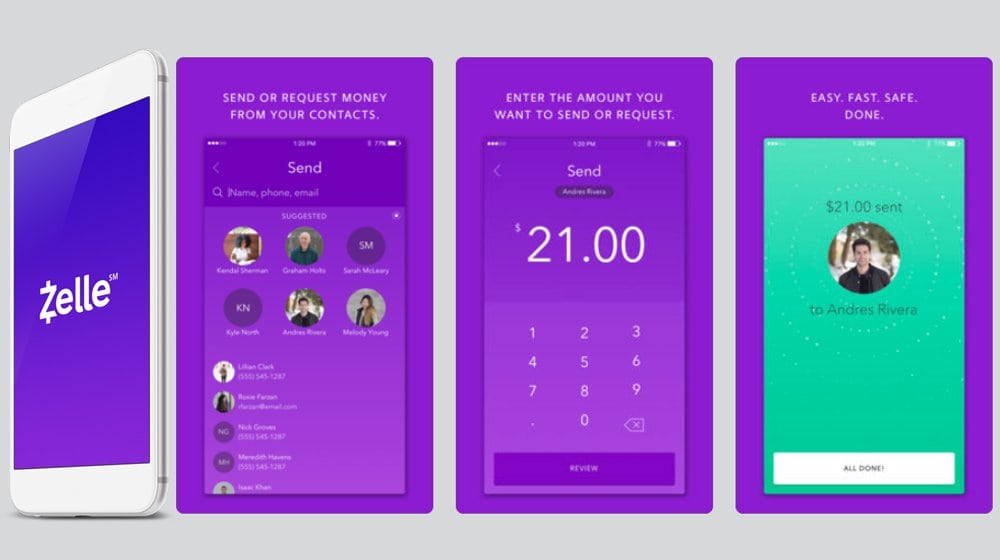

Send Money with Zelle

If a user is banking with an institution which is not part of the Zelle Network, they can download the Zelle App from the App Store or Google Play to participate.